Home » India’s Economy Lighting Up on Peak Festive Season Demand

India’s Economy Lighting Up on Peak Festive Season Demand

Photo: iStock.com/Toa55

Indian shoppers are back in force online and in stores, splurging this festive season after the COVID-19 pandemic dampened celebrations and consumption in previous years.

Online marketplaces Amazon.com Inc., and Walmart Inc.-owned Flipkart saw sales jump 27% from a year ago to $5.7 billion during the festival season’s first sale between September 22-30, consulting firm RedSeer estimated. Traders estimate spending of about 2.5 trillion rupees ($30.2 billion) at stores.

This year’s Diwali, the festival of lights that falls on Oct. 24 and the equivalent of Christmas in the West, will be India’s first season of celebration since the pandemic began without virus-related restrictions. The return of shoppers will serve as a boost to consumption, the backbone of the economy.

Here are four charts that help explain the broader consumption trends:

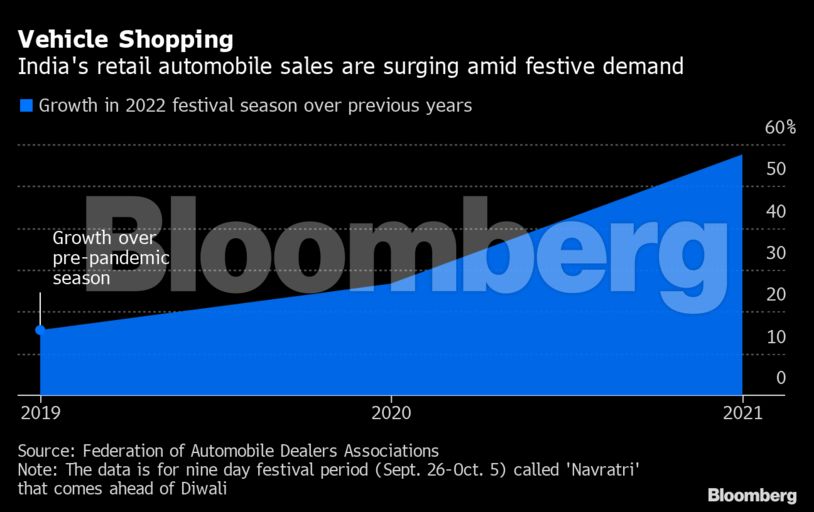

New vehicle sales jumped 57% from a year ago during the nine-day ‘Navratri’ period that precedes Diwali, data from the Federation of Automobile Dealers Associations show. Sales of two-wheelers in India, an indication of rural demand, grew 3.7% from 2019 levels. Cars and sports utility vehicles sales soared 92% in September from a year earlier, according to Society of Indian Automobile Manufacturers.

India’s largest carmaker Maruti Suzuki India Ltd. saw demand for its cars rise 20% year-on-year, led by its premium offering. “The growth numbers have been uniform in both urban and rural centers,” said Maruti’s Executive Director Shashank Srivastava, with higher interest rates doing little to suppress demand.

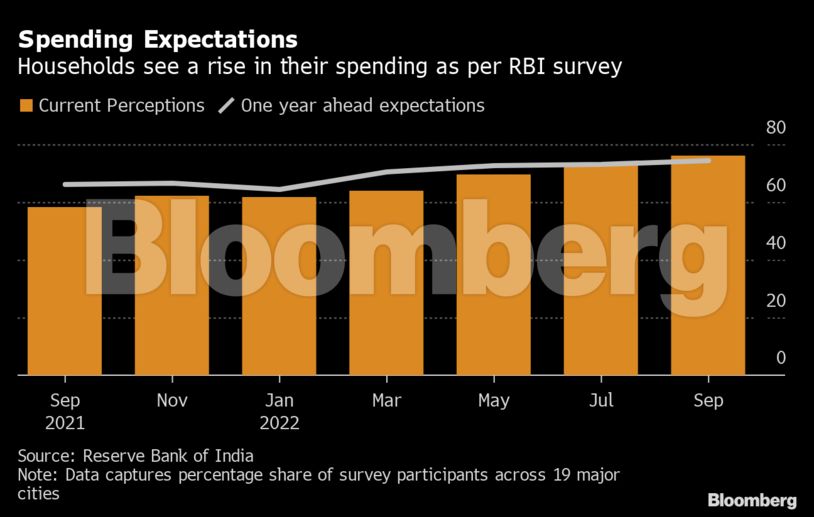

“For the first time in three years this festival season is seeing robust demand,” said Gaurav Kapur, chief economist of IndusInd Bank. “Since the start of the year, people are spending on goods and services, mall footfalls are increasing, and airline seat occupancy rates have jumped despite high ticket prices.”

RELATED CONTENT

RELATED VIDEOS

Subscribe to our Daily Newsletter!

Timely, incisive articles delivered directly to your inbox.

Popular Stories

2024 Supply Chain Management Resource Guide: There's Only One Way Off a Burning Platform

VIEW THE LATEST ISSUECase Studies

-

Recycled Tagging Fasteners: Small Changes Make a Big Impact

-

Enhancing High-Value Electronics Shipment Security with Tive's Real-Time Tracking

-

Moving Robots Site-to-Site

-

JLL Finds Perfect Warehouse Location, Leading to $15M Grant for Startup

-

Robots Speed Fulfillment to Help Apparel Company Scale for Growth