Home » U.S. Set to Ship Record Crude Into 2023 as Energy Crisis Deepens

U.S. Set to Ship Record Crude Into 2023 as Energy Crisis Deepens

August 25, 2022

U.S. crude sales overseas are set to hit fresh records through next year as American oil increasingly takes market share in Europe.

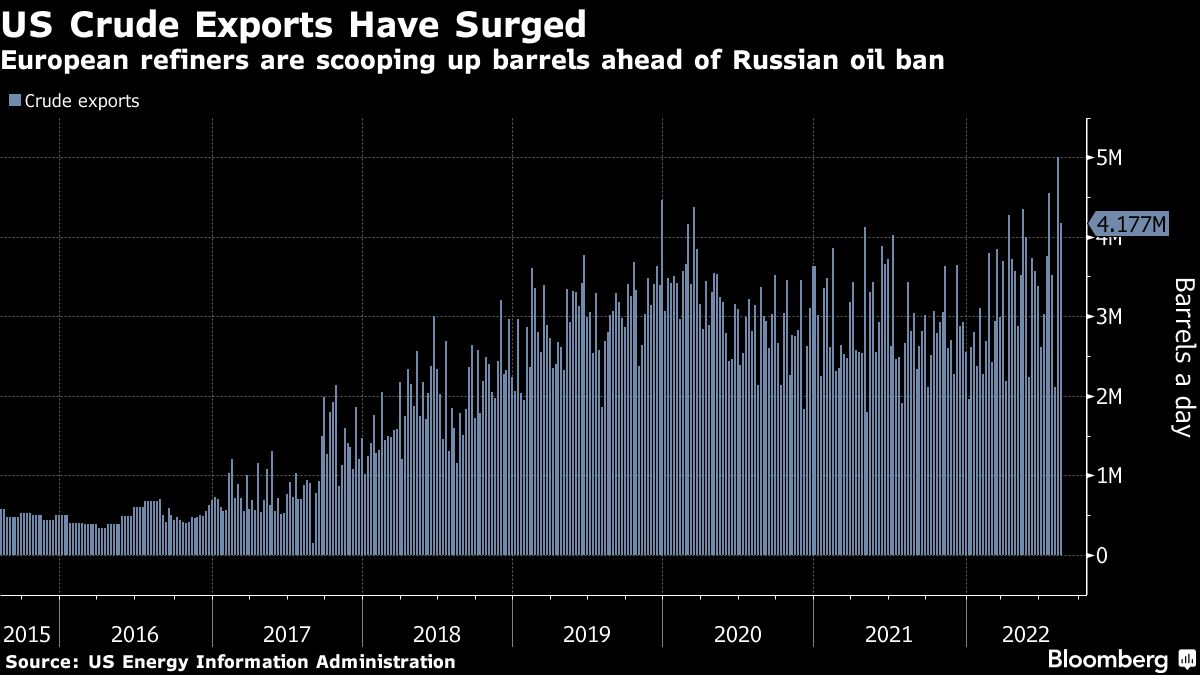

Earlier this month, weekly government figures showed an unprecedented 5 million barrels a day of U.S. crude being exported. Shipments are poised to average over 4 million barrels a day over the next few months and into next year, according to the most optimistic in the oil industry.

In a world grappling with one of the worst energy crises in history, the U.S. is steadily becoming the go-to supplier of incremental barrels. It’s likely to remain in that position as OPEC+ spare capacity is limited and the EU looks to wind down most Russian crude purchases in December. Fuel prices soared after Russia’s invasion of Ukraine upended flows, while “extreme” volatility in the oil futures market as a result of low liquidity has prompted Saudi Arabia’s oil minister to consider further supply cuts despite shortages in consuming nations.

U.S. suppliers that have captured market share across Europe will likely hold onto it over the next two years as other producers, including those in the North Sea and West Africa, have not been growing their output as steadily, said Conor McFadden, head of oil for Europe at Trafigura, among the biggest exporters of U.S. crude.

While the end of American reserve oil releases this fall might slow exports briefly, it’s unlikely to dent these mammoth outflows long term, according to a poll of industry analysts. U.S. drillers have been growing production, even if at moderate rates, and the country’s refining capacity is not expected to expand, leaving more oil for export. In fact, weekly exports have exceeded 4 million barrels a day for consecutive weeks for the first time since the export ban was lifted at the end of 2015, according to the latest Energy Information Administration data released Wednesday.

Annual U.S. crude shipments abroad are expected to average from 3.3 million barrels a day to as high as 3.6 million barrels a day this year, from nearly 3 million in 2021, according to oil analysts at ESAI Energy, Rapidan Energy Group and Kpler. Outflows are likely to average as much as 4.3 million next year, according to ESAI oil analyst Elisabeth Murphy.

Much of that will cater to Europeans drawing new supply lines ahead of the December boycott of Russian energy by the region’s trade bloc. Currently, the U.S. accounts for only about 16% of Europe’s waterborne crude imports, up slightly from 15.3% before the war, said Vortexa senior oil market analyst Rohit Rathod.

And there’s room to capture more Russian market share. “EU-27 countries are still taking about 1.1 million barrels a day of Russian seaborne crude,” said Kpler oil analyst Matt Smith.

It’s not just about filling Europe’s gaping energy hole left behind by Russia either. American flows already are replacing barrels from other traditional suppliers to Europe, including Kazakhstan where its flagship CPC crude has seen multiple export disruptions because of technical problems.

U.S. volumes are nipping into West Africa’s market share in Europe as well as helping offset disrupted crude flows from Libya due to politically-driven production outages, said Hunter Kornfeind, an oil market analyst at Rapidan.

European refiners have become more comfortable using American oil that is shipped reliably and stably, Trafigura’s McFadden said. “When the world’s energy supply chains got so stressed, this was the crude that filled the hole. When Europe didn’t know who they were gonna buy from they went to Midland because they know it will arrive,” he said.

The influx of U.S. barrels has also pressured regional European crudes. At the start of the week, Ekofisk crude, a light-sweet grade in the North Sea that competes with U.S. supplies, was trading about $3.50 above Dated Brent. That compared with about $7 a month earlier. Meanwhile Forties crude, another North Sea grade, was trading at a discount of 70 cents to Dated Brent compared with a premium of more than $5 a month prior.

Looking ahead, purchases from Asia are also key in keeping U.S. crude exports elevated. Over the past two months, Asian countries have scooped up large volumes of American oil, as competition with Middle Eastern supplies heats up. Even so, greater volumes of Russian oil are still headed to China and India since the invasion of Ukraine.

“The long-term trend in a world that needs more oil is that the U.S. is going to be exporting more,” McFadden said.

RELATED CONTENT

RELATED VIDEOS

Subscribe to our Daily Newsletter!

Timely, incisive articles delivered directly to your inbox.

Popular Stories

-

-

Diversifying Production From China: Welcome to ‘The Great Reallocation’

-

U.S. Fleet Professionals Look Toward Sustainability to Cut Down on Rising Operating Costs

-

Next-Generation Packaging Brings Reliability and Visibility to Supply Chains

-

E-Commerce Boom: Easing Supply Chain Pressure with Omnichannel Supply Chains

2024 Supply Chain Management Resource Guide: There's Only One Way Off a Burning Platform

VIEW THE LATEST ISSUECase Studies

-

Recycled Tagging Fasteners: Small Changes Make a Big Impact

-

Enhancing High-Value Electronics Shipment Security with Tive's Real-Time Tracking

-

Moving Robots Site-to-Site

-

JLL Finds Perfect Warehouse Location, Leading to $15M Grant for Startup

-

Robots Speed Fulfillment to Help Apparel Company Scale for Growth