Visit Our Sponsors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

An independent government report on President Donald Trump’s new North American trade deal estimates it will lead to higher car prices for U.S. consumers and a decline in auto sales even as it has a modest positive impact on the broader economy, undercutting one of the White House’s key sales pitches for the agreement.

In its assessment of the new U.S.-Mexico-Canada Agreement, the International Trade Commission found it would have a modest beneficial impact on the American economy, adding 0.35 percent, or $68bn, to U.S. gross domestic product in the sixth year after it took effect.

The report, however, offered a much more skeptical view of tough new auto production rules, saying that while they would add 28,000 jobs in the auto sector they would actually lead to a fall in vehicle assembly jobs due to higher production costs that would be a drag on U.S. manufacturing more broadly.

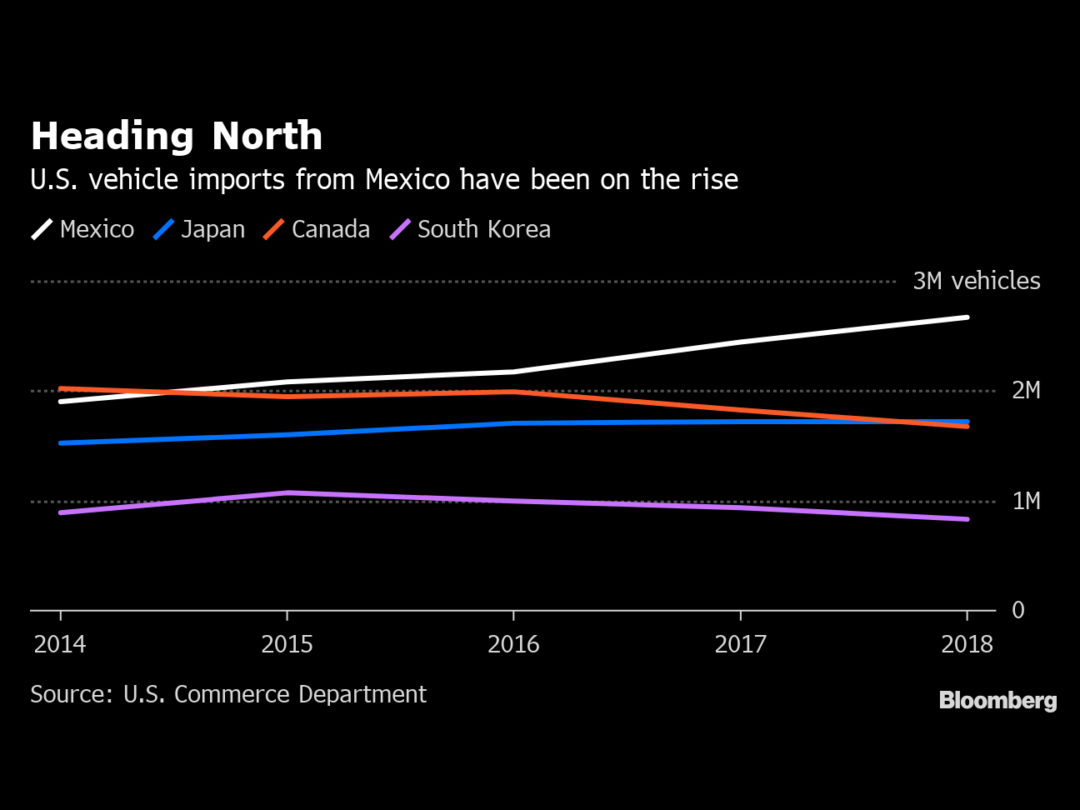

The ITC analysis points to a debate over one of the Trump administration’s main argument for USMCA as it seeks lawmakers’ approval in the months to come: That it will lead to a surge in investment and jobs in an auto sector that has become one of the main drivers of the rising trade deficit with Mexico over the past 25 years.

White House Pushback

In a separate analysis released last week, administration trade officials said the USMCA would lead to $34bn in new auto investment in its first five years and 73,000 new jobs.

Kevin Hassett, the chairman of Trump’s Council of Economic Advisers, also raised questions about the ITC’s analysis of the auto sector. The CEA’s own estimate for the broader impact of the USMCA was that it would add $100bn annually to the U.S. economy once it was fully implemented.

“If we really do get $100bn more GDP, it is hard to imagine that auto sales will go down,’’ he said in an interview. “That’s a very big positive to GDP.’’

The ITC’s congressionally-mandated report on the likely economic impact found that the strict new auto rules in the USMCA would lead to higher prices for cars in the U.S., reduced consumer choices, the sale of 140,000 fewer vehicles and a modest decline in auto assembly jobs. The 1,500 jobs lost in vehicle production, the ITC said, would be offset by a gain of almost 30,000 jobs in parts production thanks in part to increased manufacturing of engines and transmissions in the U.S.

U.S. vehicle prices would also increase from 0.4 percent for pickup trucks to 1.6 percent for small cars.

The ITC also found the increased cost of producing cars in the U.S. resulting from the USMCA may have a broader negative impact by drawing “resources away from other manufacturing sectors and the rest of the U.S. economy, driving up production costs for other sectors.” The result, ITC economists wrote, would be reduced U.S. exports, real incomes and employment in the overall economy.

Rules of Origin

A senior USTR official told reporters Thursday that the ITC’s auto estimates were less positive than its own because the ITC did not have access to privileged commercial information automakers had shared with the administration. The ITC had also only modeled the impact on engine and transmission production rather than the entire parts supply chain, he said.

The ITC’s findings fit arguments made by auto industry and other analysts during the USMCA negotiations as the Trump administration pushed the tougher rules of origin. The rules require 75 percent of vehicles to be produced in North America and 40 percent to be made in plants with an average wage of $16 an hour or higher.

In its effort to get ahead of the ITC report, the Office of the U.S. Trade Representative portrayed a surge in new investment as resulting from the USMCA, listing $15.3bn in new investments announced in recent months by automakers.

Many of those investments, however, had been decided on long before the USMCA was finalized.

Volkswagen said in November, roughly two months before announcing a new electric vehicle production plant in Tennessee, that Trump’s tariff and trade war threats were making it difficult to plan investments.

A spokesman for Volkswagen said that while no trade deal of this magnitude is perfect, USMCA would provide the industry with a high degree of certainty and clarity necessary to make long-term investment decisions.

Toyota in March added about $3bn to a U.S. investment plan announced in January 2017, but the initial plan was already to spend $10bn over five years. Toyota and Mazda also announced a plan to build a joint U.S. factory in August 2017 and solidified Alabama as the location in January 2018.

A Ford Motor Co. spokeswoman said the announcement included in USTR’s report had first been unveiled in 2017, though the company believed the USMCA would help create good-paying manufacturing jobs in the U.S.

Auto Industry Support

Part of the problem, said Kristin Dziczek, of the Center for Automotive Research, was that investments in new auto plants were often announced multiple times and hard to attribute to trade agreements such as the USMCA. “There’s a whole lot of ingredients in making an investment decision, and trade is just one of them,’’ she said.

Mindful of the need for congressional approval for the USMCA and eager to end the uncertainty Trump has caused by threatening to end Nafta, auto industry groups sided with the administration Thursday.

The American Automotive Policy Council, which represents the big three U.S. automakers, said the ITC report underestimated the longer-term investments and increased U.S. auto parts sourcing “as a result of the certainty and predictability the USMCA will deliver.’’

Another group, the Auto Alliance, said USMCA’s benefits would only be realized if the Trump administration removed tariffs on steel and aluminum imports and did not impose further duties on autos and auto parts, as the president has threatened.

RELATED CONTENT

RELATED VIDEOS

Timely, incisive articles delivered directly to your inbox.