Home » Rush to Beat Trump Tariffs Turns Into Another Headwind for China

Rush to Beat Trump Tariffs Turns Into Another Headwind for China

January 31, 2019

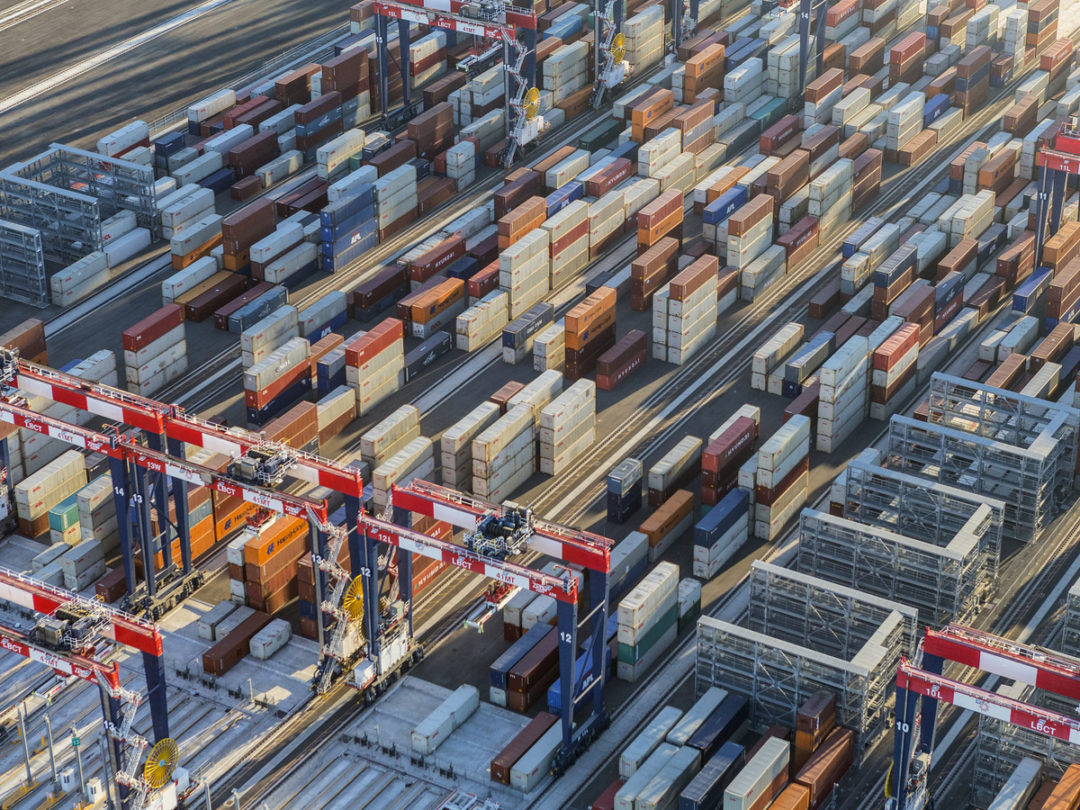

Warehouses in southern California are full to bursting with Chinese goods rushed across the Pacific ahead of President Donald Trump’s tariff deadlines.

“It’s been quite a run in the last six months,’’ says Phillip Sanfield, a spokesman for the Port of Los Angeles, which ended 2018 with its busiest December on record with the equivalent of more than 900,000 20-foot containers moving through its docks.

Those chock-a-block dockyards seen in mid-January are evidence of a phenomenon in global trade which economists are still struggling to capture the full extent of: “front loading.”

Customers for Chinese goods brought forward their orders in the expectation that duties would rise at the end of 2018, cushioning the blow from the trade war on China’s economy through most of 2018. Problem is, that forward buying means that fewer orders than normal are set to get booked now, depressing trade at the start of the year.

How this distortion in the U.S.-China trading relationship combines with the other risks to China’s export performance this year will help determine how bad the slowdown in the world’s second-largest economy will become.

Anecdotal evidence suggests front-loading was significant. Yet it’s tougher to isolate it as a factor when looking at economic data from either side of the Pacific Ocean.

“A trawl of the latest data provides limited support for the thesis,” according to Chang Shu, David Qu and Tom Orlik at Bloomberg Economics. “It might not be a significant factor at the macro level. Either way, we think exports are in for a hard time this year, given continued uncertainty surrounding the China-U.S. trade talks and signs of weakening global demand.”

Global Pattern

Chinese Vice Premier Liu He was in Washington Wednesday for the start of what the White House is describing as “very, very important” talks on trade this week, as a March 1 deadline that could see higher tariffs on $200bn of Chinese goods approaches. With knotty issues from intellectual property to the bilateral imbalance still unresolved, there’s little sign yet that an agreement is likely.

That, plus signs of cooling demand from the U.S. to Europe and emerging Asia have had economists busy writing down their estimates for goods sold abroad by China, the world’s largest exporter. Forecasters surveyed by Bloomberg now see exports growing at just 4 percent in 2019 down from more than 11 percent last year and 1.5 percentage points lower than the consensus forecast in December.

The Bloomberg Economics analysis led by Chang Shu shows that China’s exports picked up across a number of regions during the second half of 2018, not just to the U.S., signaling healthy demand in the global economy.

“Assuming the slightly higher growth of China’s exports to the U.S. was due to front-loading in the second half of 2018, we estimate the amount attributable to that factor to be a negligible 0.2 percent of 2018 exports,” the economists wrote.

Whatever the extent of front loading, the strength of worldwide demand is the key determinant of how robust global trade is right now. One indicator of that, shipping rates on the Hong Kong to Los Angeles route, show while that the boom from 2018 is definitely gone, prices have also been slower to pick up ahead of the Chinese New Year than in previous years.

Robert Koopman, chief economist of the World Trade Organization, said recent data from China confirmed the slowdown in global trade that many expected was underway as the impact of Trump’s trade wars filters through the global economy. January trade data from China is scheduled for release on Feb. 14.

Lawrence Leung, managing director of Sun Hing Knitting Factory Ltd., which makes a range of garments in Hong Kong and China for global markets, said his industry is seeing demand come off.

“The whole trade is feeling a little bit of a pinch from the slowing down in the States,” he said.

RELATED CONTENT

RELATED VIDEOS

Subscribe to our Daily Newsletter!

Timely, incisive articles delivered directly to your inbox.

Popular Stories

2024 Supply Chain Management Resource Guide: There's Only One Way Off a Burning Platform

VIEW THE LATEST ISSUECase Studies

-

Recycled Tagging Fasteners: Small Changes Make a Big Impact

-

Enhancing High-Value Electronics Shipment Security with Tive's Real-Time Tracking

-

Moving Robots Site-to-Site

-

JLL Finds Perfect Warehouse Location, Leading to $15M Grant for Startup

-

Robots Speed Fulfillment to Help Apparel Company Scale for Growth