Visit Our Sponsors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

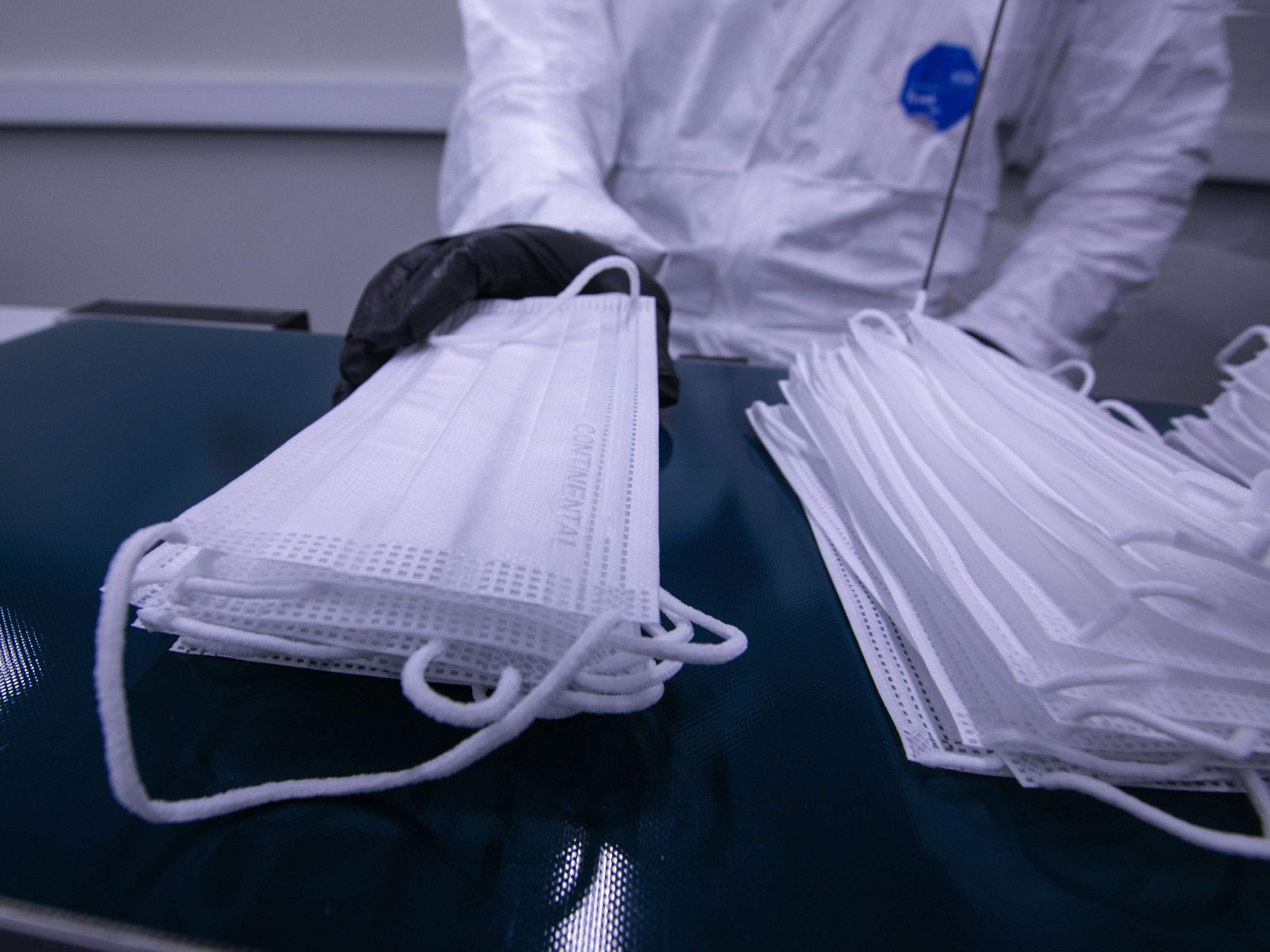

An employee gathers protective face masks from a production line conveyor. Photo: Bloomberg.

The coronavirus pandemic has led to severe shortages of personal protective equipment (PPE) needed to protect Americans from the disease. The crisis has revealed an overreliance on imported supplies, particularly from China. Now, American manufacturers are working to establish a reliable source of essential materials in the U.S. In this conversation with SupplyChainBrain Editor-in-Chief Bob Bowman, Tom Pelliccio, executive vice president of Pilot Freight Services, details the progress being made, and the prospects for a permanent, reliable domestic supply of PPE.

SCB: Can we shift production of PPE to the United States?

Pelliccio: The answer is yes. How fast and how furious it comes is another matter, but we're already seeing a move from China to Southeast Asia, then from Southeast Asia and near-sourcing in Mexico, and back to the United States. The technology is coming. The machinery is on its way. The facilities have been picked out, and we are already picking up shipments in truckloads today, moving them to clients and hospitals.

SCB: Going forward, do you think we’re still going to need to import some of those materials?

Pelliccio: Absolutely. I don't see a clean sweep, at least in the next 24 to 36 months, because of the need for imported raw materials. In today's environment, 80% of nitrile medical gloves come out of Malaysia. I don’t see the U.S. upsetting that market and having those produced locally. Other items, such as three-ply masks and medical gowns, are of a different nature. I've seen chemo-rated plastic medical gowns being manufactured here. So I think there will be a balance. We'll always see something coming out of China, Southeast Asia, and also Turkey, which has been strong in medical gowns as well.

SCB: Are there any other country sources that might be added to the mix?

Pelliccio: We're starting to see an uptick in Thailand, and some initial interest in Cambodia. Vietnam has been extremely strong as well.

SCB: To what extent will these be dedicated manufacturers, versus those that have temporarily pivoted from making a different kind of product?

Pelliccio: Most of the manufacturing is dedicated, especially on the glove and mask side. I think it will stay that way for quite some time. We have alcohol manufacturers dedicating lines to hand sanitizer, which will stay in effect, but if they're going to make more money producing alcohol, they'll switch those lines back. As of right now, I see the hand sanitizer lines staying where they are here in the U.S.

SCB: What challenges do U.S. manufacturers face in retooling their facilities to make this production uptick possible?

Pelliccio: Two things would be timing and certain types of equipment they're bringing in. Equipment is coming from Germany, but manufacturers aren’t sure if this is going to last for three months, six months or the next five years. They’re asking, should we invest with dollars before we have to switch these lines back over, or will they stick?

Remember, we've been in this since February. A lot of goods have been brought into the country. The cost of masks has come down. The cost of gloves has gone up because of the need for nitrile and the shortage of raw materials. But manufacturers are looking to see if there's an overabundance, and whether pricing going to stick.

SCB: It must be hard to pivot so quickly. I can't imagine you'd want to risk standing up an entire production facility domestically, only to see demand tail off when the pandemic's over.

Pelliccio: Absolutely. It's a risk. But I've seen other companies that have long-term contracts with their customers. We're going to be using medical gowns and nitrile gloves in the U.S. whether COVID-19 is here or not. And their use in food handling has gone up. The average public might not be wearing them, but I think gloves are going to be around for a very long time.

SCB: I'm guessing in a time of such uncertainty, the one thing we could count on is that we’ll be relying less on China for all this material going forward.

Pelliccio: In the environment we're in today, tariffs on certain goods drive people to other parts of the world.. If there’s a duty or tax on a particular PPE commodity coming out of a developed country, that item will find its way to the lowest cost. So underdeveloped countries will get a bigger crack at that. I believe China will always have a portion of that market; that will never dry up. It's too big. There’s too much coming in, too much at risk. In this day and age where our strategic stockpiles are as low as they are, I believe China will still play a major part. But you will see a shift, and we see it today.

SCB: What must logistics providers do to adjust to these changes in sourcing?

Pelliccio: They needed to be ahead of this early on, before COVID-19. You have to follow the clients and understand what they’re saying today. When they shifted to Southeast Asia over the last couple of years, logistics providers had to make sure their operations in that region were extremely strong. More importantly, they had to be prepared to bundle their services. Customers today want to know that you're a cradle-to-grave carrier, that you can take it from the end of the manufacturing line straight through to the client shelf. You need to be not just an air freight forwarder, but a good non-vessel operating common carrier as well. You have to cover international transportation, customs clearance, warehousing and domestic distribution. You’ve got to touch product three or four times to be successful in the long term with your customers today.

SCB: How can we protect against future shortages in times of sudden need? Will we need to build up buffer stock and inventories, maybe even government-mandated reserves?

Pelliccio: We're already seeing that in clients' contracts. They're looking to have 90- or even 120-day reserves with just-in-time management for their end customers, where traditionally they might have had 30 days in stock. So our logistics and warehousing opportunities continue to grow. You’ll see higher inventories, and items getting into the strategic stockpile. Whether it's COVID-19 or the next pandemic, we have to be prepared on a national level when it comes down to vaccines and all types of products, not just PPE.

RELATED CONTENT

RELATED VIDEOS

Timely, incisive articles delivered directly to your inbox.