Visit Our Sponsors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The top U.S. maritime regulator said stretched global supply chains pushing ocean-freight rates to record highs may stay strained into 2022, raising concerns about whether small American companies can weather another year of a tangled transport system and much higher costs.

“As you see the pandemic lift, I think you’re going to see changes in what’s demanded but demand is going to go up even further,” Dan Maffei, chairman of the Federal Maritime Commission, said in an interview last week. “If this is primarily a supply and demand issue, then unfortunately it’s going to continue because the supply is limited” and “the demand just keeps on going up.”

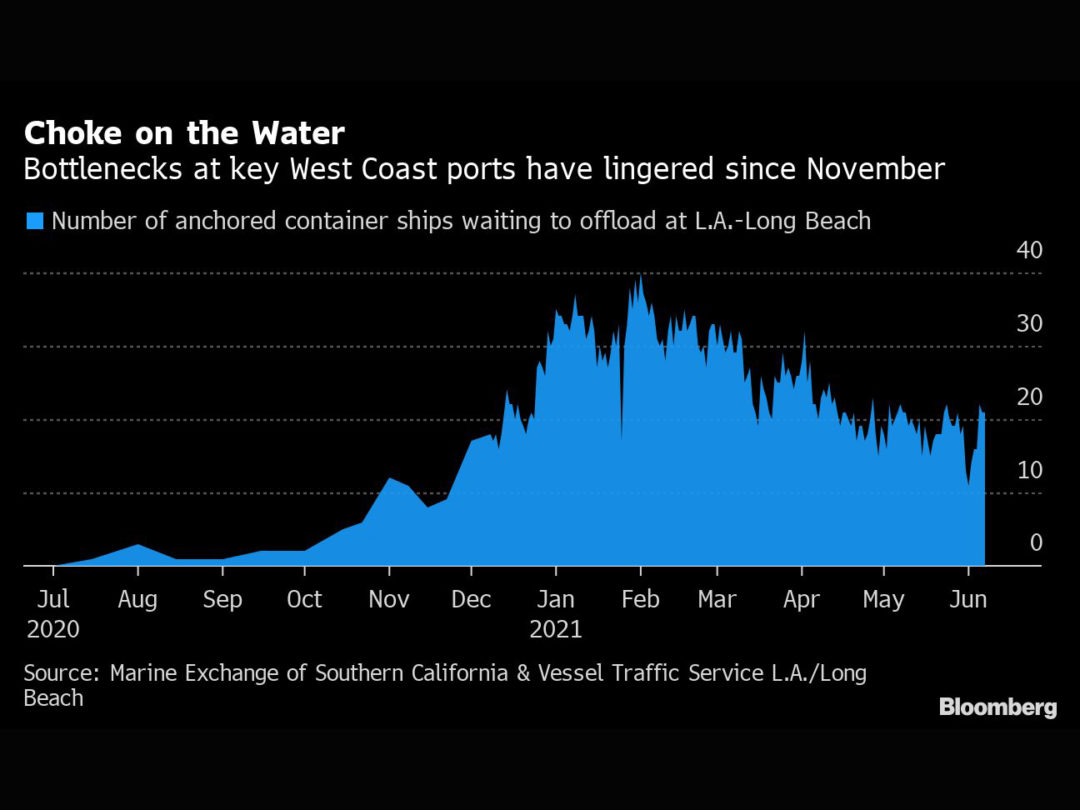

U.S. ports are struggling to work through bottlenecks of goods imported on container ships, while the rail and truck networks that disperse them across the country are strained with equipment and labor shortages. The supply snarls are colliding with a surge in demand for goods as the world’s largest economy heads for peak shipping season — July and August, when retailers build inventories heading into the year-end holidays.

“I definitely think it will hit a ceiling at some point but back-to-school, through the fall, Christmas probably, you’re going to see into 2022 when you finally see a slowdown, and maybe not even then if there’s enough of a backlog,” Maffei said.

He said such a tight market potentially poses medium-term difficulties and is “not a short-term issue.”

Maffei, a former congressman from New York state, said he worries about the effect on smaller U.S. importers and exporters, particularly American agricultural shippers of goods abroad. “If your business model was just based on the very, very low freight rates that we had for many years, then it may be outdated now,” he said.

Asked about inflation, Maffei said it’s “not something we want to see, but it is the market’s way of resolving that — to a certain extent they will pass that on to their customers.”

Still, “the percentage of the cost of an import that’s based on the ocean transportation cost was small enough that even if you increased that by a couple of fold, you’re still not going to change the price all that much,” he said.

Meanwhile, container carriers that struggled for most of the past decade with overcapacity and losses are facing the opposite now: almost no slack to meet all the demand and soaring profits because they’re able to charge three and four times the pre-pandemic cargo rates.

Record Quarter

The world’s largest private and publicly held container carriers collectively posted record profit of $19.1 billion in the first quarter, more than double the previous all-time high of $9.1 billion set the prior quarter, according to figures compiled by industry veteran John McCown, founder of Blue Alpha Capital.

“We have a system that is at or beyond capacity, pretty much everywhere in the world,” Maffei said. “The carriers have everything they have on the water and still don’t have enough space on the ships for all the demand.”

In Washington, the National Retail Federation cautions that its members are among those bearing the brunt of the problems.

U.S. container ports may have had their busiest month on record in May, the retailers group said this week.

“The disruption issues are leading to significant additional costs for businesses and delays in getting products to consumers,” said Jonathan Gold, the industry group’s vice president for supply chain and customs policy. “Most of these costs are not being passed to the consumer given the current economy, further impacting the economic recovery of retailers both large and small.”

Maffei, an FMC commissioner whom President Joe Biden designated as chairman in late March, said a lot of companies are complaining to the FMC about the surge in charges.

“It’s not for us to decide whether it’s fair or not unless they arrived at that through some unreasonable means like artificially limiting supply,” he said. “Frankly, there’s nothing we can do about it because our law doesn’t allow us to.”

RELATED CONTENT

RELATED VIDEOS

Timely, incisive articles delivered directly to your inbox.

.jpg?height=100&t=1715228265&width=150)