Visit Our Sponsors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

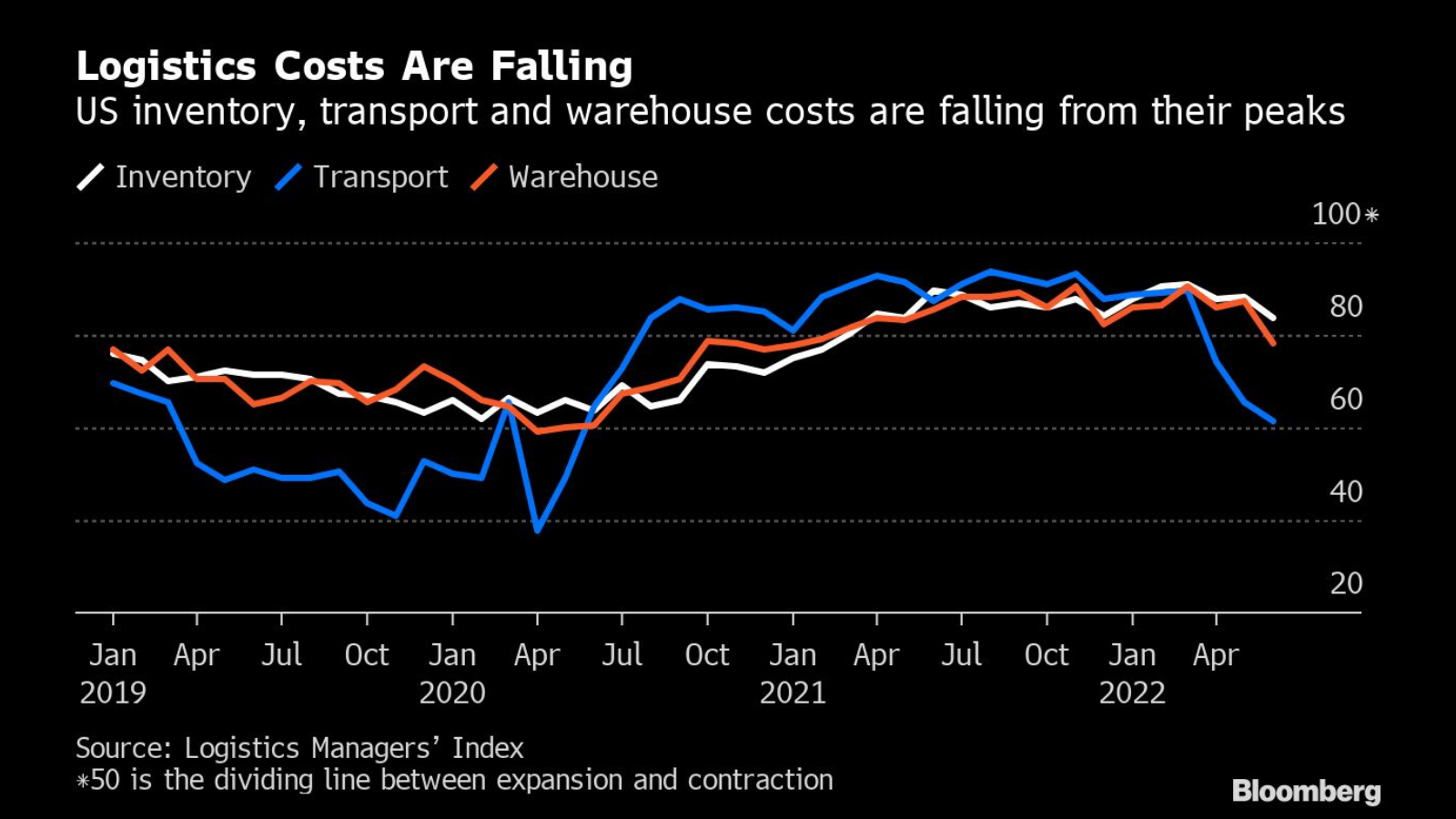

An indicator of U.S. supply chain pressure fell to the lowest level in two years, as a sharp drop in transportation costs underscores the slowdown in the nation’s economy heading into the second half of the year.

The Logistics Managers’ Index declined to 65 in June, the third straight fall from a record of 76.2 reached in March and the lowest level since July 2020, the monthly report released Tuesday showed. It was the first time since mid-2020 that the reading came in below the all-time average, currently at 65.3.

“While this does still represent a healthy rate of expansion in the logistics industry, it is a far cry from three months ago,” the report stated.

The weakening figure “is reflective of what we have seen in the overall economy in the last three months, moving from the record-setting expansion of the last 18 months to the greatly subdued level of growth observed throughout the second quarter,” the report said. “Up until 2022, we saw high demand for transportation and warehousing and difficulty building up inventories. June’s report is the opposite.”

The index’s gauge of transportation prices fell to 61.3, a third straight monthly decline and just below the transportation capacity’s reading of 61.7. “When these two lines invert, it often means a serious economic shift has taken place,” the report said.

But the future index for transportation prices posted a reading of 59.6, “indicating expectations of slight price increases for the next year.”

Inventory costs declined as levels rose to a reading of 71.8, “marking the fifth time in six months that metric has come in over 70.0 — something that had only happened twice before 2022,” according to the report.

Meanwhile, warehouse prices, capacity and utilization all retreated, though “we are not seeing the dramatic price drops for warehousing that we are seeing with transportation,” the report said.

RELATED CONTENT

RELATED VIDEOS

Timely, incisive articles delivered directly to your inbox.