Home » More Than Half U.S. Firms in China See Lockdowns Hitting Revenue

More Than Half U.S. Firms in China See Lockdowns Hitting Revenue

May 10, 2022

China’s stringent Covid Zero strategy has damaged foreign businesses’ confidence, with U.S. firms in the country slashing investments and lowering revenue projections as lockdowns hit operations and supply chains.

More than half of the 121 companies polled by the American Chamber of Commerce in China have either reduced or delayed investment in the country, while nearly 60% of them lowered their income forecasts for this year following the latest outbreaks, according to a statement.

“We understand China choosing to prioritize health and safety above all else, but the current measures are throttling U.S. business confidence in China,” Colm Rafferty, chairman of AmCham China, said in the statement. “An already challenging situation continues to worsen,” he said, adding that companies “don’t see any light at the end of the tunnel.”

New virus clusters emerging across China since March have led to stringent lockdown measures, causing a sharp contraction in economic activities and a slowdown in export growth. While top leaders have pledged to support the economy, they have also defended the Covid Zero strategy that seeks to eliminate all infections.

Read more: Global Supply Chain Crisis Flares Up Where It All Began

Before the latest wave of omicron-led outbreaks, China recorded $107 billion worth of net inbound foreign direct investment in the first quarter, up 12% from the same period last year. That’s after it jumped by nearly a third in 2021 from 2020, official data shows, as China’s control of the outbreak in those two years allowed the economy to quickly rebound, boosting profits and business activity.

However the increasing restrictions and growing concern from foreign firms about Covid control policies are undermining that trend. If the Covid Zero lockdowns continue, they will likely further damage the prospects for economic growth and make it harder for foreign business to expand.

More than 15% of the U.S. companies with operations in Shanghai — which has been placed under lockdown for more than a month — reported their business there remains fully shut, according to the survey conducted between April 29 and May 5.

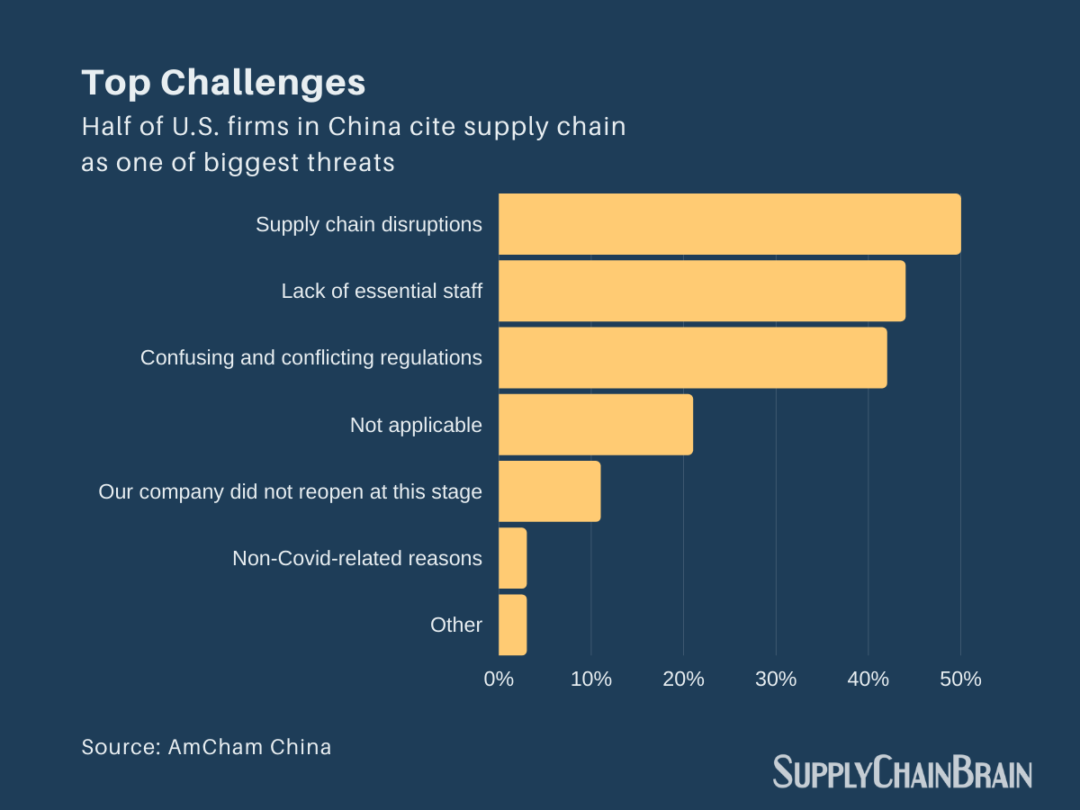

Nearly 60% of the respondents, who have operations throughout China, said production capabilities were slowed or reduced due to a lack of employees, difficulty in getting supplies, or government-ordered lockdowns. While almost a quarter of the surveyed companies said China’s recent policy measures to improve logistics have had a positive impact on their operations, another 41% report continuing damage from supply chain disruptions.

Read more: An American Toymaker Doubles Down on Sourcing in China During the Pandemic

Over 70% of the companies expect revenue or profit to be hit if the current Covid control policy remains in place for the next year. More than half of them also anticipate reducing investment and loss of expatriate staff in this scenario, according to the survey.

Over a quarter of the companies have lost more than 30% of their foreign staff in China due to Covid restrictions and quarantines since the start of the pandemic, according to the survey. More than half of the respondents said the country’s handling of the pandemic has had a medium-to-severe impact on their ability to attract or retain skilled foreign staff.

Nearly 40% of the respondents said they were not satisfied with China’s Covid management. Their top complaints are the length of quarantines, restrictions on travel to the country and lack of flights, according to the survey.

RELATED CONTENT

RELATED VIDEOS

Subscribe to our Daily Newsletter!

Timely, incisive articles delivered directly to your inbox.

Popular Stories

2024 Supply Chain Management Resource Guide: There's Only One Way Off a Burning Platform

VIEW THE LATEST ISSUECase Studies

-

Recycled Tagging Fasteners: Small Changes Make a Big Impact

-

Enhancing High-Value Electronics Shipment Security with Tive's Real-Time Tracking

-

Moving Robots Site-to-Site

-

JLL Finds Perfect Warehouse Location, Leading to $15M Grant for Startup

-

Robots Speed Fulfillment to Help Apparel Company Scale for Growth