Visit Our Sponsors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Conventional wisdom in the transport sector has moved rather quickly from “electric cars aren’t happening” to “the future of all cars is battery powered.” But that only applies to light vehicles. There is still a healthy debate among executives of top automakers and analysts on what type of drivetrain will come to rule long-haul trucking.

It’s not an academic debate either. The demand for goods transported by road is expected to increase 50% by 2040, according to BloombergNEF. That growth could account for 40% of the increase in global oil demand in the next few decades, according to the International Energy Agency. And medium and heavy commercial vehicles are the types of road transport that are furthest from where they need to be to help the world meet climate goals, according to BNEF’s Electric Vehicle Outlook.

And because the debate is not settled, Volvo Group is hedging its bets. “We are going in parallel with three technologies,” said Lars Stenqvist, chief technology officer at the Swedish multinational, which owns the trucks manufacturing division Volvo Trucks. The company is developing trucks that run on batteries, hydrogen fuel cells and combustion engines that burn biofuels, synthetic fuels and even hydrogen.

Stenqvist said battery electrics are already the choice for buses, excavators and reloaders like refuse collectors. “There is no reason for any city in the world to buy anything else than battery electric refuse collectors,” he said in an interview with Bloomberg Green at the World Economic Forum in Davos last month. Volvo Trucks was the market leader for heavy all-electric trucks in Europe last year with a market share of 42%, the company said, referencing statistics from market analysis group IHS Markit. Volvo is going further on its all-electric investments by building a charging network, as part of a joint venture, specifically for battery-powered heavy-duty vehicles.

Fuel cells, however, are a different game. While in theory tanks of hydrogen emptied via fuel cells can provide superior range that matches fossil-fuel versions, the drivetrain has struggled to gain market share because there are few incentives to build enough hydrogen-filling stations as there are gas stations in the world.

Stenqvist isn’t worried. The reason hydrogen produced from renewables didn’t become a fuel of choice in the past, he said, is because it wasn’t cheap enough to produce. That’s no longer the case. “We believe we will get low-cost green hydrogen,” he said. “It’s because other industries will be very dependent on green hydrogen. Take steel, chemicals or aviation. In the long run, our estimate is that less than 10% of green hydrogen will be used for transport. So we will piggyback on the big investments across the globe on hydrogen.”

Read more: Russia’s War Supercharges Push to Make New Green Fuel

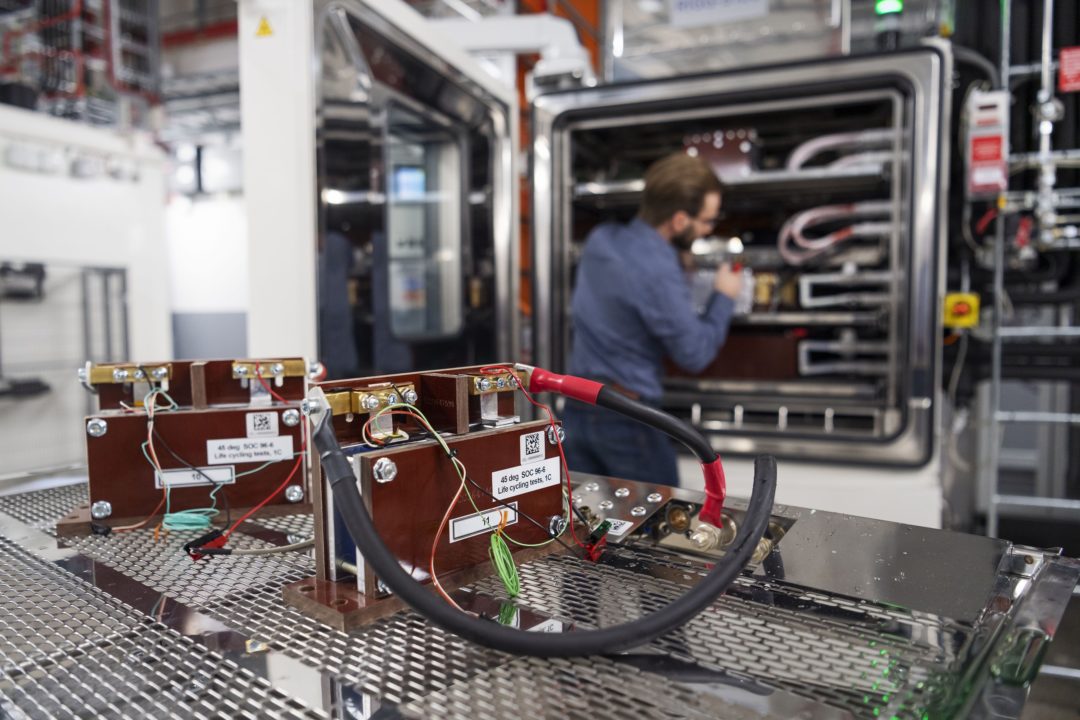

Volvo isn't going alone. For fuel-cell development, it’s working with Daimler Truck AG. The joint venture called “cellcentric” will supply fuel cells to both companies starting in 2025, even as they compete to sell trucks to customers.

While making internal combustion engines for biofuels (derived from crops) or synthetic fuel (derived from captured carbon dioxide) isn’t exactly cutting edge at the moment, few automobile manufacturers are considering burning hydrogen gas in engines. The cost of developing all these technologies simultaneously is already weighing on Volvo, said Stenqvist. While Volvo Group does not always split spending by divisions, the company spent nearly 20% of its gross income in 2021 on research and development.

What’s clear is the winning technology hasn’t been decided yet. “When I talk to my engineers, I talk about it as a beauty contest,” Stenqvist said. “Three teams in parallel are sort of competing with each other.”

Why stretch the company so much? “My belief is that the type of drivetrain will be dependent on the infrastructure in different regions and the price of energy there,” he said. Some places it will be cheap to buy biofuels, while in other places it will be cheap to get green hydrogen.

For proof, Stenqvist says look at the sales of zero-emission heavy trucks in China. Though a small proportion of total vehicles sold, the trend seems promising. “It is clear that in China everyone is investing in hydrogen,” he said.

It’s not just the drivetrain that Volvo has to worry about. The company has set out a target to have net-zero emissions by 2050, which would mean all the vehicles it sells from 2040 onward need to be zero-emission vehicles. “I will definitely not open any door for offsets,” Stenqvist said. Because if you do, “you will not take it seriously. You can always plant a tree here and plant a tree there and avoid the tough discussions.”

That’s meant focusing not just on the fuel its vehicles burn, but also the emissions attached to the materials needed to build the vehicle. It’s one reason why Volvo is one of the first members to sign up to the First Movers Coalition that’s collating the demand from different global companies for green alternatives of everyday commodities. As part of its delivery, this month Volvo unveiled the world’s first vehicle made entirely from fossil-free steel.

RELATED CONTENT

RELATED VIDEOS

Timely, incisive articles delivered directly to your inbox.

.jpg?height=100&t=1715228265&width=150)

.jpg?height=100&t=1715141311&width=150)