Home » Walmart's Usual Victims Are Becoming New Allies in India

Walmart's Usual Victims Are Becoming New Allies in India

April 8, 2019

Walmart Inc. is making friends in India with the kind of competitors that it spent decades putting out of business in the U.S. — mom and pop stores.

These unlikely allies are part of the latest attempt by the Bentonville, Arkansas-based behemoth to crack the country’s giant consumer market, taking on e-commerce arch-rival Amazon.com Inc. and Asia’s richest man, Mukesh Ambani.

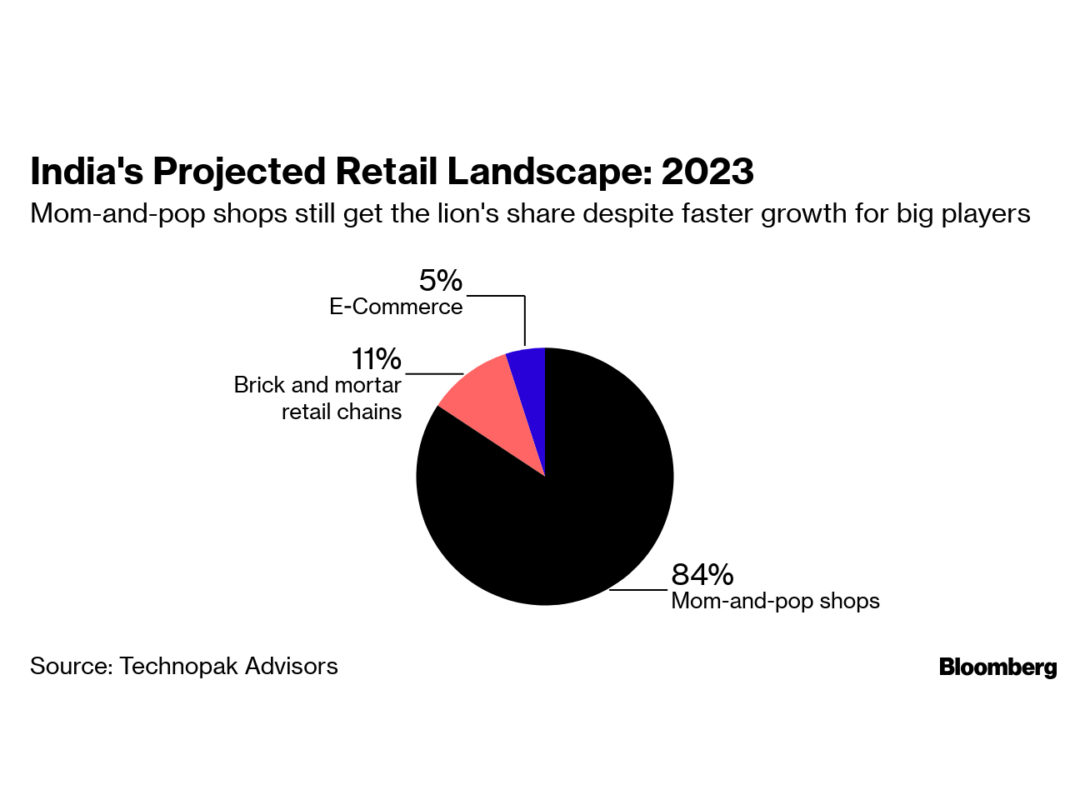

Years of lobbying by global retailers failed to persuade the Indian government to open its market to foreign competition, because of fears that it may put out of business many of the 12 million neighborhood stores that account for almost 90 percent of the country’s retail sales. Walmart’s attempt to build an e-commerce business to reach consumers was also hampered by new regulations.

So the U.S. company is now rolling out a plan to more than double its wholesale chain in India over the next four years — supplying the local storeholders instead of competing with them. The move intensifies the three-way brawl with Amazon and Ambani. Each has a different strategy, but they all need to woo the owners of the ubiquitous neighborhood shops.

"Our single biggest agenda is: ‘How can they become more loyal to us?’" Krish Iyer, chief executive officer of Walmart’s India unit said in an interview in the company’s newest outlet in the southern city of Karimnagar. "The expansion phase will continue because the opportunity in India is huge."

Karimnagar is classic territory for Walmart, which built its empire with warehouse-sized retail outlets on the edges of second-tier American cities. The city, known for its massive quarries of red and brown granite slabs, is the fastest-growing urban center in the landlocked state of Telangana.

Barred from opening retail stores, Walmart started the wholesale business in India in 2009, but continued to try to find a way to sell direct to the public. Its most recent attempt — the $16bn purchase of homegrown e-commerce leader Flipkart last year — was dealt a blow when the government came out with new rules designed to protect the 12 million small shopkeepers from online competition too.

Walmart’s biggest competition comes from Ambani, who isn’t subject to the restrictions on foreign companies and already controls India’s largest brick and mortar retail chain, as well as a network of wholesale stores that is twice the size of Walmart’s. Now, Asia’s richest man plans to use his 290 million-subscriber mobile phone network to create an e-commerce giant. India’s small shopkeepers are key to that too.

Little more than a month after the government’s new e-commerce policy was released, on a stage he shared with Prime Minister Narendra Modi, Ambani announced his first move online would be a marketplace exclusively for the owners of the small stores, called kiranas.

Meanwhile, Amazon is working to recruit shopkeepers in small towns and villages, arming them with smartphones to place orders for local residents and relying on them to deliver goods in communities that often have no street names or house numbers.

Amazon and Reliance Retail did not reply to requests for comment.

"More and more aggressively they are trying to on-board kiranas," said Rajat Wahi, a partner at Deloitte’s consumer services practice in New Delhi. "All the volumes go through that channel, albeit in very small lots. So the objective of these players is: how do I get more active selling to these mom-and-pop-stores."

Walmart’s Iyer wouldn’t say how much the company is investing to win these shopkeepers over, but he said 26 more of its Best Price wholesale stores were planned by 2023, with each location costing between $8m and $10m. And another 8 to 10 new sites were being identified each year for after that.

Walmart’s strategy allows shopkeepers to see and touch products before purchasing — unlike Amazon — and doesn’t compete with its customers by selling direct to consumers — which Ambani does.

"Our members when they come here, they will not find their customers shopping in the store," Iyer said, without naming any competitor. "I will sell only to small resellers."

He said no integration with Flipkart is planned — the e-commerce firm has its own board and CEO, while Walmart India is a wholly owned subsidiary of the U.S. parent.

Instead, the Best Price wholesale business is using the internet to try to build loyalty among its clients. It’s running a pilot program to help buyers sell goods online to their own customers. Best Price also has its own website and app that allow clients to order online. For those who are uncomfortable placing orders on the web, Walmart sends out employees called business development associates with tablet computers to help shopkeepers and even provide free consultations to modernize their kirana stores.

That can include changing the store design. Most kiranas look like old-fashioned general stores where the shopkeeper gets what you need from behind the counter, but many customers prefer the self-service model of Western supermarkets.

"For two weeks they helped a lot, the initial set up," said Rajnikanth, 42, an investment adviser who, like many south Indians, goes by one name. He decided to start a shop in the southern Indian city of Hyderabad after noticing his neighborhood lacked such self-service stores. "Almost morning to evening every day they worked here."

His Sai Best Buy Super Mart has aisles of Lays potato chips next to packaged versions of traditional Indian snacks like moong dal, and Head & Shoulders shampoo beside the almond and coconut hair oils beloved by Indian women. Almost all of the stock comes from Walmart’s store about 10 minutes away.

Standing outside the store, Rajnikanth said Walmart gave him advice on how to compete with organized retail chains like Ambani’s Reliance Retail, with tips such as offering free local delivery, even if it’s for only one item.

"This fraternity is wanting to innovate, wanting to digitize, wanting to find new ways of making the business more profitable," Walmart’s Iyer said. "They’re open to new ideas."

RELATED CONTENT

RELATED VIDEOS

Related Directories

Subscribe to our Daily Newsletter!

Timely, incisive articles delivered directly to your inbox.

Popular Stories

2024 Supply Chain Management Resource Guide: There's Only One Way Off a Burning Platform

VIEW THE LATEST ISSUECase Studies

-

Recycled Tagging Fasteners: Small Changes Make a Big Impact

-

Enhancing High-Value Electronics Shipment Security with Tive's Real-Time Tracking

-

Moving Robots Site-to-Site

-

JLL Finds Perfect Warehouse Location, Leading to $15M Grant for Startup

-

Robots Speed Fulfillment to Help Apparel Company Scale for Growth