Visit Our Sponsors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vacant storefronts are the scourge that is eating New York City. At least, that’s been the story for the past couple of years.

Bleecker Street in Greenwich Village went from high-end fashion destination to a row of empty shops reminiscent of the Rust Belt. Manhattan’s Upper East Side has been “facing a retail vacancy epidemic.” Manhattan Borough President Gale Brewer bemoaned 188 vacant storefronts along the length of Broadway, and a New York Times photo essay on vacant storefronts cited a “survey conducted by Douglas Elliman,” a real estate brokerage, that purportedly found about 20% of Manhattan retail space to be vacant, up from 7% in 2016. That statistic has been repeated widely since, even though when Rebecca Baird-Remba of the Commercial Observer followed up, nobody at Douglas Elliman could confirm it.

Recently, though, two city agencies have finally come through with real numbers, and the picture they paint isn’t nearly as dire. Retail vacancy rates have risen in the city over the past decade, at least through last fall, but only by a couple of percentage points. New York’s retail vacancy problems may actually be smaller than those facing most of the rest of the country as online shopping keeps gaining market share. And while the City Council has been considering legislation to limit landlords’ ability to raise rents on commercial tenants, asking rents have been falling rapidly in many of the city’s retail districts.

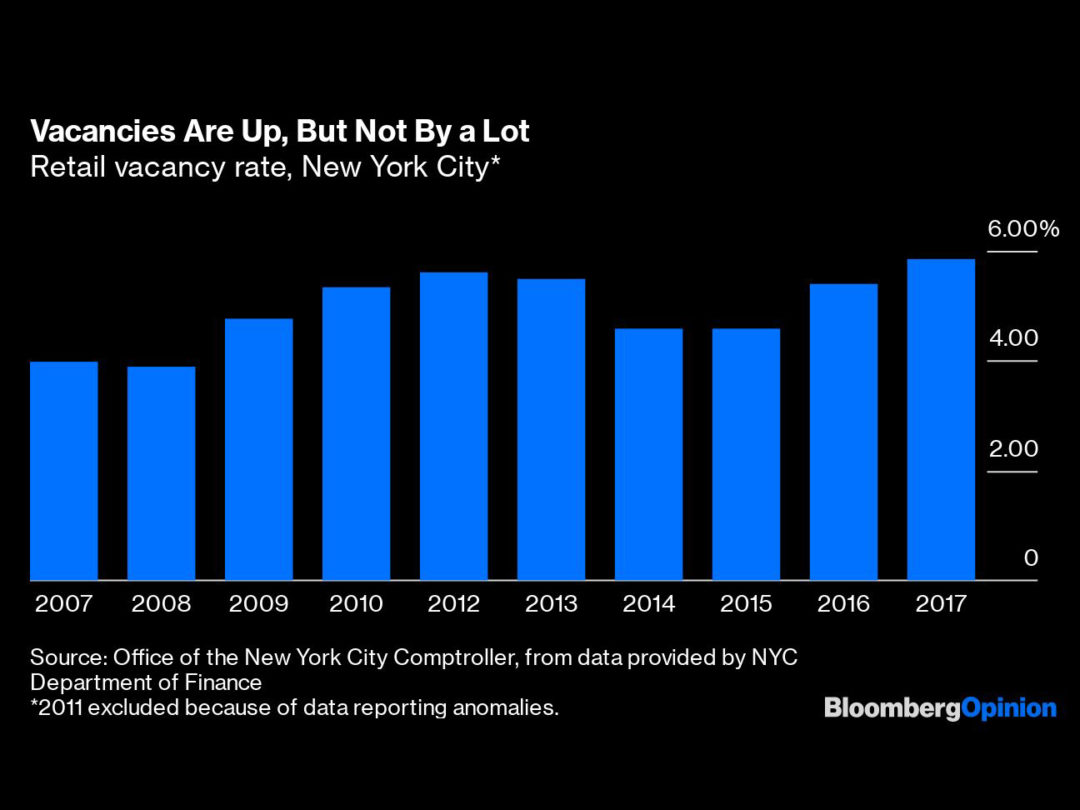

How bad is the vacant storefront problem in New York, and how much worse has it gotten? In a survey of 24 neighborhoods in all five boroughs that was released in August, the Department of City Planning found that the percentage of retail storefronts that were vacant averaged 11.6% in late 2017 and 2018, ranging from 5.1% in Jackson Heights in Queens to 25.9% along Canal Street in Manhattan. In eight neighborhoods that the department had also surveyed in 2008 and 2009, the percentage of vacant storefronts had risen from 7.6% to 9%. Then, in September, City Comptroller Scott Stringer published a report using administrative data from property tax filings to estimate the percentage of retail square footage in the city that was vacant — the way commercial vacancy rates are usually expressed — and found that it had risen from 4% in 2007 to 5.8% in 2017.

Vacancies Are Up, But Not By a Lot

In raw numbers, the Comptroller’s office found that the city had 142 million square feet of retail space in 2007, 5.6 million of them vacant, and 202.8 million square feet in 2017, 11.8 million of them vacant. These numbers do have quirks, such as the fact that some owners of smaller retail properties aren’t required to file the Real Property Income and Expense forms from which the data are derived. But it’s nice to finally have some data, and the story they tell rings true, especially when you break things down by borough.

Depends on the Borough

Vacancy rates are down since 2010 in the Bronx, Brooklyn and Queens, which have all been having a pretty good decade, economically speaking. They’re up in Manhattan, which has also been having a good decade but has by far the most retail space and highest rents. Then there’s Staten Island, which is much less urban than the rest of the city and has seen less recent economic and population growth — and now has a retail vacancy rate in the double digits.

Staten Island’s retail vacancy line looks a bit like the one for large shopping malls nationwide. Despite a growing economy and strong consumer spending, the national mall vacancy rate was 9.4% in the fourth quarter, as high as it was during the aftermath of the worst recession in 75 years, and almost twice as high as before the recession.

There's Room at the Mall

“Retail is in a process of evolution,” says Victor Canalog, chief economist at Moody’s Analytics Reis, the source of the national data. “Some are handling it better than others.” Department stores and clothing retailers are struggling, while restaurants, nail salons and other businesses that are less vulnerable to online disintermediation aren’t. New York City happens to be really big on restaurants, nail salons and other you’ve-got-to-be-there storefront businesses.

Moody’s Analytics Reis also measures vacancy rates for “neighborhood and community shopping centers,” aka strip malls. For them the national vacancy rate was 10.1% in the third quarter of this year, which is about where it’s been since 2014 when the data series begins. The company doesn’t track New York City retail because so much of the space is in residential and office buildings, but third-quarter vacancy rates were 11.7% in Central New Jersey, 8.9% in Northern New Jersey and 7.4% in Fairfield County, Connecticut. So while the numbers may not be perfectly comparable, New York City’s retail vacancy rate of 5.8% doesn’t seem at all out of line with what’s been going on in the rest of the region and the country. In fact, it seems like it might be on the low side.

So why has there been so much gnashing of teeth about the city’s vacant storefronts? Well, we New Yorkers do like to complain. Also, because the city has added so much retail space (like the big new Hudson Yards development), the sheer amount of vacant space is up more sharply than the vacancy rate. And there definitely are some well-known shopping streets with eye-catching numbers of vacant spaces. The most shocking tend to be in what the Department of City Planning refers to as “hot corridors” — established or rapidly changing areas in Manhattan and Brooklyn where rents rose a lot before the vacancy uptick and building owners have resisted price cuts. “Some owners kept spaces vacant while seeking high rents,” according to the department’s report. “In many cases, they had promised certain rent levels and a ‘credit tenant’ to their lenders in order to secure favorable loan terms.” What’s a credit tenant? “Typically large retailers with a national footprint.”

This sure seems to be what’s been going on along Canal Street, which was formerly known for its very local and far-from-posh retailers of electronics, hardware, art supplies and counterfeit brand-name goods and is now transitioning into something more conventional. On Bleecker Street it’s a more involved story that apparently started with the 1996 opening of Magnolia Bakery, which, after being featured in an episode of “Sex and the City” in 2000, began attracting crowds from all over the world who wanted the cupcakes that they had seen Carrie and Miranda eat. Retailer Marc Jacobs soon followed in the crowds’ wake, and other fashion brands followed Marc Jacobs. From a New York Times retrospective published in 2017:

“During its incarnation as a fashion theme park, Bleecker Street hosted no fewer than six Marc Jacobs boutiques on a four-block stretch, including a women’s store, a men’s store and a Little Marc for high-end children’s clothing. Ralph Lauren operated three stores in this leafy, charming area, and Coach had stores at 370 and 372-374 Bleecker. Joining those brands, at various points, were Comptoir des Cotonniers (345 Bleecker Street), Brooks Brothers Black Fleece (351), MM6 by Maison Margiela (363), Juicy Couture (368), Mulberry (387) and Lulu Guinness (394).”

In the end, though, the theme park failed to attract enough paying visitors. It was a failed retail experiment that was enormously disruptive to the neighborhood and the small businesses that had previously served it, and I totally get why it makes steam come out of some people’s ears.

Still, Bleecker Street is now making a low-key comeback, thanks to asking rents that are 40% lower than they were just three years ago. (Oh, and Magnolia Bakery is still there, and now has locations in four other U.S. cities and seven foreign countries.)

The Bleecker Street data only start in 2008 because the Real Estate Board of New York, a trade association, didn’t consider it a major retail corridor before then (it still doesn’t consider Canal Street one), which is why I’ve included a nearby stretch of Broadway in Soho to give a sense of what probably happened before 2008. The first 15 years of this century were a time of major retail rent increases in Manhattan, with some of the biggest in neighborhoods that were already quite expensive.

Expensive Retail Corridors

One thing that stands out is what has happened to the stretch of Madison Avenue with high-end department store Barneys near its south end and what used to be an unbroken succession of smaller and in many cases even higher-end clothing and accessories retailers to the north. This corridor saw big rent increases in the 2000s, and was the highest-rent retail zone in the city for much of that decade, but since the financial crisis its rents haven’t come even close to keeping up with those in the tourist-clogged shopping districts to its south. The Madison Avenue retail business model was about selling very expensive tangible goods to rich people, in person, and it has been struggling for a while. Barneys filed for bankruptcy in August and the blocks north of it are now pocked with empty storefronts.

By contrast, retail space in Times Square and along Fifth Avenue in midtown is used as much for branding and entertainment as for selling goods, and that has held up better. Will it continue to hold up? I don’t think anybody knows — Neiman Marcus and Nordstrom are embarking on grand new ventures in the city this year even as other department stores struggle or leave town. Retail is changing, and the long leases and high transaction costs in commercial real estate markets make adjustment to those changes slow and uneven. But the adjustments do come.

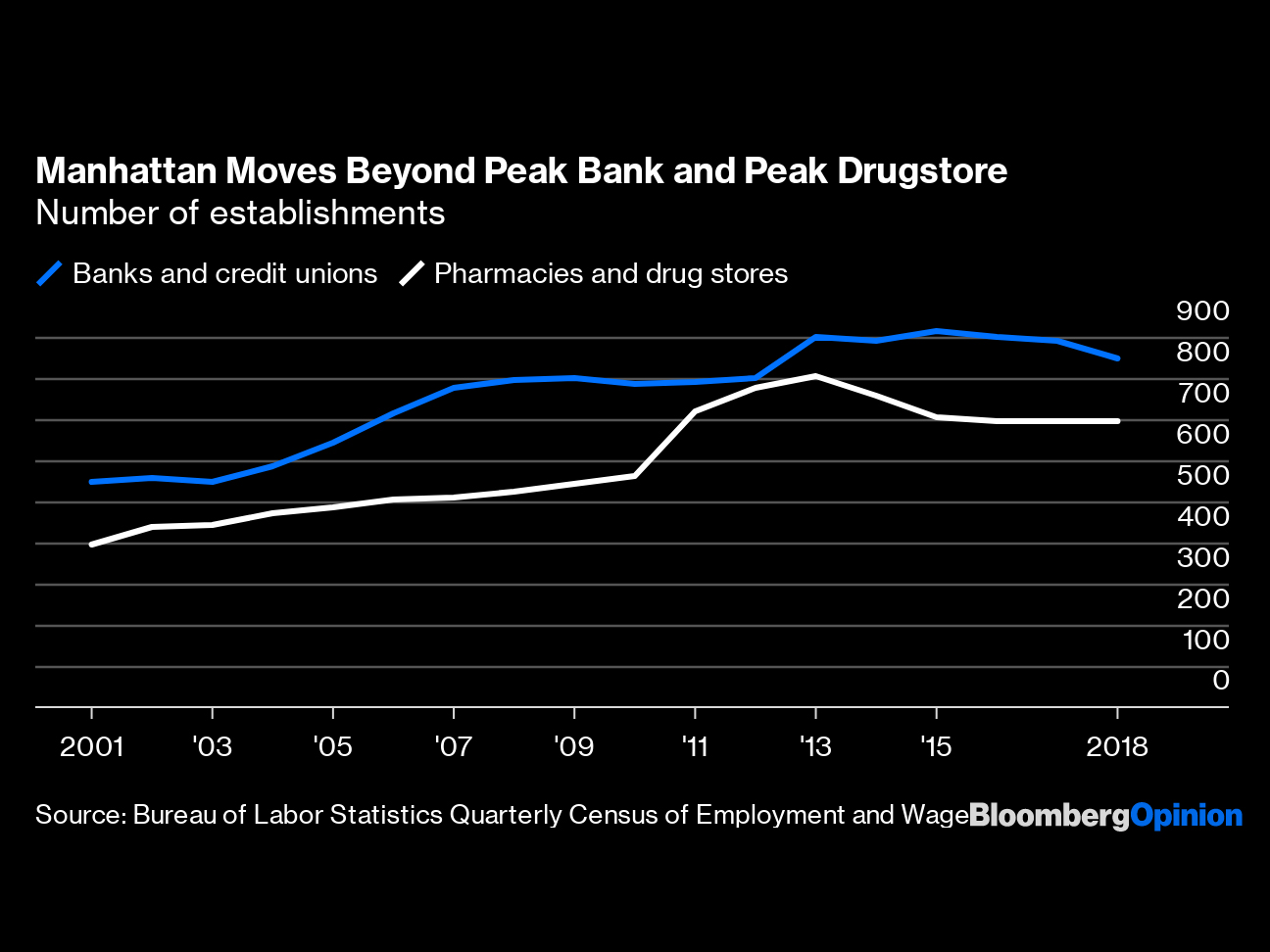

I’ve been living near Broadway on Manhattan’s Upper West Side and just north of it for most of the past two decades, and that thoroughfare has been in an ongoing retail transition for the whole time, with lots of boarded-up storefronts to show for it. One cause is the rising neighborhood affluence (aka gentrification) that has led building owners to raise rents higher than long-established merchants could bear. Another has been the desire of “large retailers with a national footprint” to expand into neighborhood shopping districts around the city, which further encouraged building owners in their rent aspirations. The two kinds of retailers that seem to have expanded the most in Manhattan over the past couple of decades are bank branches and drugstores. Their expansive era may have ended, though:

If I were a commercial property owner in a neighborhood shopping district in Manhattan, this chart would make me sad. As a regular shopper in such a district, I see it as a sign that the worst may be over.

About 15 years ago, a toy store and an adjoining pizzeria or bagel shop or both (family recollections differ) on Broadway near our then-apartment shut down. My wife and I assumed the replacement would be something lame, but our then-five-year-old son hopefully speculated that the new place would be a combination toy and book store. When it turned out to be an HSBC bank branch, he was crushed. And people wonder why Gen Z distrusts capitalism!

Times change, though. About four years ago, a less-than-great toy/gift store on Broadway in our current neighborhood shut down. The space reopened in 2017 not as a bank but as Hex & Co., a board-game store and gaming parlor that also serves food and drinks and hosts classes and events. It’s been a huge success, and will be moving soon into a larger space a couple of blocks to the north. One of its owners, a former real estate executive named Mark Miller, recorded an illuminating video a few months ago in which he rails against the idea that landlords jack up rents because they secretly benefit from empty storefronts:

“[There’s] a myth, a conspiracy theory, an urban legend that somehow our vacant retail space is the result of landlords asking for inflated commercial rents because they somehow have some magic way of turning that into cash or tax breaks on the back end. To me that’s just crazy talk. What benefits you is getting a solid tenant who can pay a sustainable rent.”

Miller goes on in the video to say that succeeding in storefront retail now requires experimenting with more lines of business than just selling goods that can be acquired online, that landlords are “cautious creatures,” that lining up a retail lease is a complex affair “more like a kidney donation than it is like going to the store to buy a sweater” and that city regulations that weigh heavily on small businesses are a problem.

A multivariate regression analysis of the vacancy data conducted as part of the Comptroller’s office study backed up a couple of these assertions, finding statistically significant associations between vacancy rate increases and:

The link between rising rents and rising vacancy rates does indicate that even though landlords do not have a magic way of turning vacant retail space into cash, they’re more likely to hold space vacant if they think it will rent for more in the future. Falling rents should eventually shift that equation. REBNY tracks retail rents for Broadway from 72nd Street to 86th Street on the Upper West Side, and they were lower last spring than at any time since 2007. Adjusted for inflation, they haven’t been this low since 2002. Let the retail experimentation begin.

RELATED CONTENT

RELATED VIDEOS

Timely, incisive articles delivered directly to your inbox.

.jpg?height=100&t=1715228265&width=150)